[ad_1]

Ideally, your total portfolio ought to beat the market common. However in the event you decide the suitable particular person shares, you can make extra — or much less — than that. The Comfort Retail Asia Restricted (HKG:831) inventory worth is down 32% over 5 years, however the complete shareholder return is -6.9% when you embrace the dividend. And that complete return really beats the market return of -12%. And the share worth decline continued during the last week, dropping some eight.5%. Nonetheless, this transfer could have been influenced by the broader market, which fell 13% in that point.

See our latest analysis for Convenience Retail Asia

To paraphrase Benjamin Graham: Over the quick time period the market is a voting machine, however over the long run it’s a weighing balance. By evaluating earnings per share (EPS) and share worth adjustments over time, we are able to get a really feel for the way investor attitudes to an organization have morphed over time.

Through the unlucky half decade throughout which the share worth slipped, Comfort Retail Asia really noticed its earnings per share (EPS) enhance by 7.zero% per yr. So it doesn’t look like EPS is a superb information to understanding how the market is valuing the inventory. Or presumably, the market was beforehand very optimistic, so the inventory has disillusioned, regardless of bettering EPS.

Due to the sharp distinction between the EPS progress price and the share worth progress, we’re inclined to look to different metrics to know the altering market sentiment across the inventory.

We word that the dividend has remained wholesome, in order that wouldn’t actually clarify the share worth drop. It’s not instantly clear to us why the inventory worth is down however additional analysis may present some solutions.

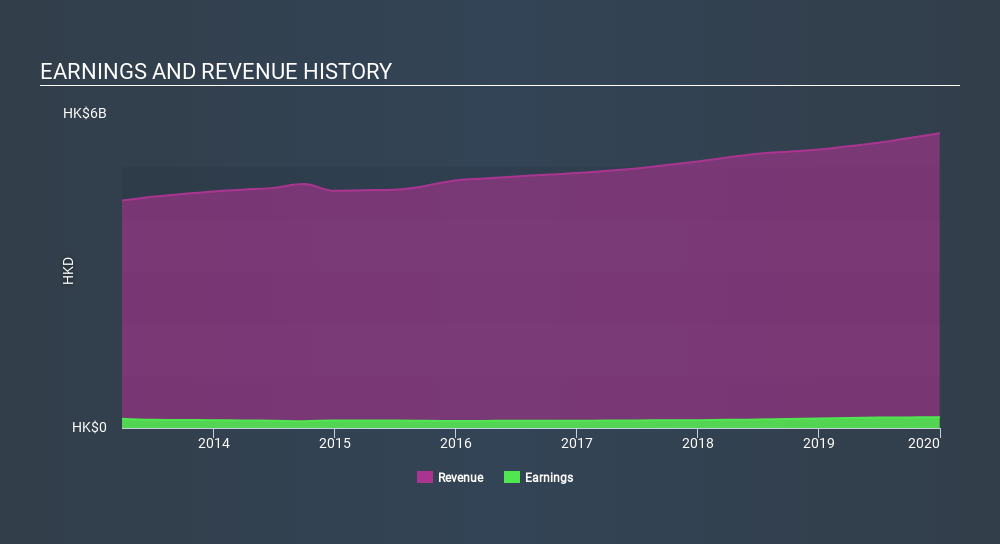

The picture beneath exhibits how earnings and income have tracked over time (in the event you click on on the picture you may see larger element).

This free interactive report on Comfort Retail Asia’s balance sheet strength is a superb place to begin, if you wish to examine the inventory additional.

What About Dividends?

When taking a look at funding returns, it is very important take into account the distinction between complete shareholder return (TSR) and share worth return. The TSR is a return calculation that accounts for the worth of money dividends (assuming that any dividend obtained was reinvested) and the calculated worth of any discounted capital raisings and spin-offs. Arguably, the TSR provides a extra complete image of the return generated by a inventory. Because it occurs, Comfort Retail Asia’s TSR for the final 5 years was -6.9%, which exceeds the share worth return talked about earlier. And there’s no prize for guessing that the dividend funds largely clarify the divergence!

A Completely different Perspective

Though it hurts that Comfort Retail Asia returned a lack of four.three% within the final twelve months, the broader market was really worse, returning a lack of 26%. Sadly, final yr’s efficiency could point out unresolved challenges, provided that it’s worse than the annualised lack of 1.four% during the last half decade. While Baron Rothschild does inform the investor “purchase when there’s blood within the streets, even when the blood is your individual”, consumers would want to look at the info rigorously to be comfy that the enterprise itself is sound. I discover it very attention-grabbing to take a look at share worth over the long run as a proxy for enterprise efficiency. However to actually acquire perception, we have to take into account different data, too. Working example: We’ve noticed 2 warning signs for Convenience Retail Asia you ought to be conscious of, and 1 of them is a bit disagreeable.

If you happen to would like to take a look at one other firm — one with probably superior financials — then don’t miss this free list of companies that have proven they can grow earnings.

Please word, the market returns quoted on this article replicate the market weighted common returns of shares that at the moment commerce on HK exchanges.

If you happen to spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This text by Merely Wall St is normal in nature. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your targets, or your monetary state of affairs. Merely Wall St has no place within the shares talked about.

We goal to deliver you long-term targeted analysis evaluation pushed by basic knowledge. Observe that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Thanks for studying.

Discounted money stream calculation for each inventory

Merely Wall St does an in depth discounted money stream calculation each 6 hours for each inventory in the marketplace, so if you wish to discover the intrinsic worth of any firm simply search here. It’s FREE.

[ad_2]